Budget 2015 must have tax breaks, allowances to cushion GST impact, say unions, employers

Concerned over the rising cost of living and worried about the impact of the Goods and Services Tax (GST), the umbrella bodies of unions and employers want Putrajaya to cushion the blow through tax breaks and living allowances to lighten the burden of companies and their employees.

The Malaysian Employers Federation (MEF) said the GST would have a huge impact on both employers and the working class due to the overall nature of the tax.

The Malaysian Trades Union Congress (MTUC), meanwhile, said the lack of any cushion may push workers to take on more jobs or work more overtime to make ends meet, with negative consequences on productivity in the long term.

MTUC secretary-general N. Gopal Kishnam suggested that a cost of living allowance (Cola) be implemented in the private sector, as practised in the civil service.

"Putrajaya has been paying Cola to civil servants for several years, why can't the private sector follow suit?" Gopal asked.

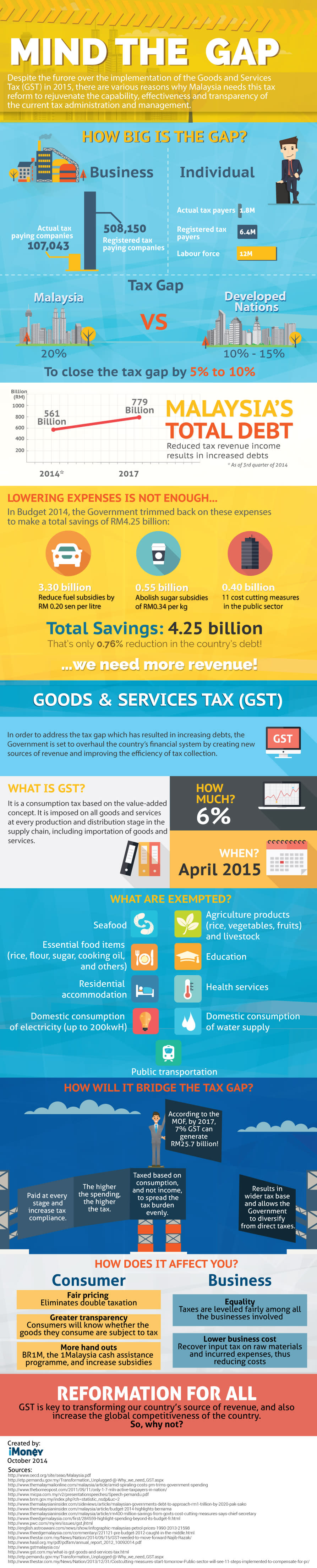

He said the actual impact of the GST had yet to register on the daily lives of Malaysian workers, many of whom earned between RM1,500 and RM3,000. The GST will be introduced in April next year at a rate of 6%.

"All workers, whether in the private or public sector, are facing difficulties in making ends meet. Cola payments may go some way towards alleviating their burden.

"Many poor workers only earn about RM1,500 a month, which they spend on their daily needs and to take care of their families.

"These workers either try to maximise their overtime claims or take up a second job just to try and make ends meet," Gopal told The Malaysian Insider.

Gopal said the long hours involved in juggling two jobs would eventually cause a worker's efficiency and productivity to suffer.

"Once the GST comes into effect in April next year, the working class in Malaysia will definitely be affected," Gopal said.

The government has said that the GST will not be imposed on essential items such as basic food stuff and some services, and also gives yearly one-off cash assistance through the Bantuan Rakyat 1Malaysia (BR1M) scheme.

But Gopal said a longer-term measure like Cola would be more beneficial.

Of Malaysia's total workforce of about 12 million, only 1.7 million are paying income tax. Those earning less than RM3,000 a month, which is the average income of the majority of Malaysian households, do not pay taxes. The GST is being introduced as a broad-based tax to cover these gaps.

Gopal added that Putrajaya should postpone the removal of subsidies until the salaries of Malaysian workers had increased to that of a high-income society.

"Otherwise, their burden will just get heavier and heavier trying to juggle the various bills on a limited income," Gopal said, adding that subsidy removals meant higher prices.

The prices of RON95 petrol and diesel were raised a further 20 sen per litre on October 2.

Gopal added that Putrajaya should also focus on making housing more affordable, as more than two-thirds of Malaysian families did not have their own properties.

The government can also help the working class keep up their household income by helping women return to the workforce after maternity by opening more daycare centres at the workplace, he said.

As for employers, MEF executive director Datuk Shamsuddin Bardan said GST would raise the cost of doing business, and this increase would be accompanied by demands for higher wages.

"2015 is shaping up to be a challenging year as the cost of running business is bound to go up, especially where raw materials for production and services are concerned.

"Therefore, not only will variable costs go up, but workers will also hope that their salaries increase, thus increasing fixed costs as well," he said in an interview.

Shamsuddin suggested that Putrajaya reduce corporate and individual income tax, noting that Malaysia's current corporate tax rate of 25% was still high compared to other Asean countries.

"MEF hopes that Putrajaya will assist the private sector by reducing taxes. If we look at neighbouring Asean countries, Malaysia's corporate tax rate is not low, it is too high," Shamsuddin said, suggesting it be lowered to 20%.

"This will help the smaller companies to continue operating, especially during tough times like this. At the same time, companies do not need to lay off workers."

Besides corporate taxes, Shamsuddin also suggested lowering the individual income tax rate, especially for the middle-income group.

"This is quite a critical matter as GST is being implemented, additional burdens will be shouldered by the middle-income group, who are the biggest contributors of income tax.

"The middle-income group spend a lot in the GST sector, such as at supermarkets, hypermarkets and major retail outlets," Shamsuddin said.

"They are the ones who will feel the biggest effect of GST once it is implemented on April 1 next year. If they are used to spending RM1,000, the cost will increase by 6%."

The maximum rate for the individual income tax band is 26%, while the corporate tax rate is 25%.

Under Budget 2014 tabled last year, the government said that personal income tax rates would be reduced by one to three percentage points for all taxpayers and the current maximum tax rate at 26% would be reduced to 24%. It said these measures would be effective in 2015.

Besides reducing taxes, Putrajaya also needs to review the current income tax relief and exemptions for taxpayers, Shamsuddin said.

"Is it friendly towards taxpayers? Does it really meet their needs? The introduction of GST means that Putrajaya has a new source of income."

Shamsuddin suggested a larger quantum in tax exemptions for contributions towards the Employees Provident Fund and the Private Retirement Scheme. – October 3, 2014.