GBP/USD Sentiment Shifting, Where to Next?

DailyFX.com -

Talking Points:

GBP/USD SSI has flipped negative

Trend line could support price

Long term buy is possible; approx. 1.60 stop, 1.70 limit

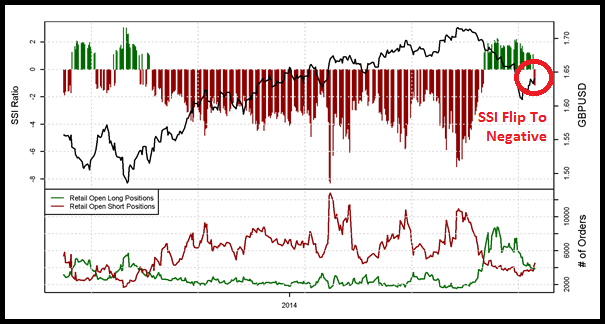

The first six months of 2014, the GBP/USD was in a strong uptrend from 1.65 to around 1.72. But it’s taken only 3 months for the GBP to give up the gains it made the first half of the year and then some. SSI has tracked these moves almost perfectly. SSI was negative throughout the entire uptrend in the GBP/USD and later flipped positive while the GBP/USD rapidly declined. A couple days ago however, the SSI flipped once again. This shift could indicate the GBP/USD is set to move higher.

SSI Flipping Negative

The image below shows the Speculative Sentiment Index (red and green) and GBPUSD’s price (black) during the past year’s uptrend and retracement. We can see that during the time that SSI was negative (red), price moved higher and during the time that SSI was positive (green), price moved lower.

A couple days ago, the SSI has flipped again to negative which could be considered a bullish signal. If SSI grows further negative, we could see GBP/USD begin to gain back its losses and possibly attempt to make a new higher high.

Learn Forex: GBP/USD SSI & Price

(Screen capture from DailyFXPlus.com)

It would be best to see that SSI does on the GBP/USD the next few days. I would personally like to see SSI at -1.5 or lower before executing a long trade.

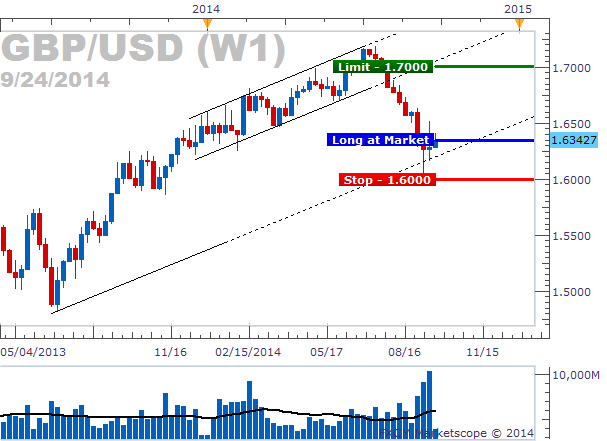

Major Trend Line on Weekly Chart

Something else I have been watching on Cable has been its reaction to the trend line extended from the low of 2013. This line was drawn parallel to the trend lines drawn during the bullish channel, a technique described in this article on Predicting Trend Lines Using Parallel Price Channels. We’ve seen two false breaks below this line the last couple of weeks with the current week’s candle staying completely above it. This kind of support is exactly what a GBP/USD bull likes to see.

With a bounce off of this trend line, the Pound could gain several hundred pips against the US Dollar without much resistance in its way.

Learn Forex: GBP/USD Weekly – Potential Supporting Trend Line

(Created using Marketscope 2.0 charts)

Potential Buy Setup

Placing a buy trade for the current setup is fairly straight forward. We have clear support from the trend line and a psychological level at 1.6000 that held the intra-week move that momentarily had broken below the trend line. Setting a stop at or below 1.6000 make sense and will give this trade a lot of breathing room. We have to remember that when taking a long term trade, stop losses are typically going to be larger. Risk can be offset by using a smaller trade size. To learn more about money management, check out our Money Management Video Course.

Learn Forex: GBP/USD – Potential Buy Setup

For our profit target, we can justify setting a limit at any price below the upper channel line and possibly setting it as high as the previous swing high. Regardless, we want it to be at least twice as far as we’ve set our stop. This would place our limit at 1.7000 or above.

Pound Picks Up its Pep

The GBP/USD could continue to rebound off its low making this a successful trade, but it could also move lower and cause buyers to lose money. There is no certainty in trading. This is why we encourage signing up for a demo account to practice trading risk-free until you are comfortable enough to trade with real money.

Good trading!

---Written by Rob Pasche

To contact Rob, email rpasche@dailyfx.com.

Sign up for my email list to stay up to date with my latest articles and videos.

Start your Forex trading on the right foot with the Forex Fast-Track Webinar Series. This 4-part, live webinar course is the disciplined Traders’ Fast-Track to the Forex Market. Topics include:

Using FXCM’s award-winning trading platform

Calculating Leverage and reducing risk

Trading with a simple (yet effective) trading strategy

Maintaining for Forex account and enrolling in on-going education

This course is completely free, so sign up or watch on-demand today.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.