Gold May Recover on US Inflation Pickup, Oil Looks to CSX Guidance

Gold may rise as a pickup in US CPI stokes inflation-hedge demand while crude oil looks to Industrial Production data and guidance from CSX Corp for direction.

Talking Points

Commodities Tread Water Overnight, Ignoring Risk Appetite Swell in Asia

Gold, Silver May Rise if Higher US CPI Print Stokes Inflation-Hedge Demand

Crude Oil and Copper Set Sights on US Industrial Production, CSX Earnings

Commodity prices are treading water in overnight trade, looking past a reactionary rally across Asian stock exchanges in the wake of yesterday’s better-than-expected US retail sales data. The release offered no meaningful direction cues to typically sentiment-geared crude oil and copper prices despite a sharp rally in the S&P 500 but proved to weigh on gold and silver, presumably having dented the likelihood of more aggressive Federal Reserve stimulus. Indeed, while Ben Bernanke and company launched QE3 last month, the size of central bank’s balance sheet continues to decrease, potentially leaving the door open for more aggressive steps beyond MBS purchases.

The spotlight now turns to September’s US CPI and Industrial Production figures. The annual inflation rate is expected to edge higher to 1.9 percent, marking the highest reading in five months. This may reinvigorate support for gold and silver as hedges against the dilution of paper currency considering the Fed seems determined to maintain an accommodative posture for the foreseeable future. Meanwhile, factory-sector output is expected to rise 0.2 percent following a sharp 1.2 percent drop in the prior month and capacity utilization is seen rebounding to 78.3 percent having hit a nine-month low in August. Signs of a pickup in industrial activity may buoy the outlook for crude oil and copper demand, sending prices higher.

On the earnings front, third-quarter results from freight transportation giant CSX Corp may stir volatility. The company is highly sensitive to the ebb and flow of the business cycle and traders will look toward its guidance to help shape the outlook for global demand trends in the months ahead. This too may produce ripples in crude oil and copper prices. A survey of economists polled by Bloomberg suggests that the markets’ consensus expectations for global growth this year and in 2013 have been revised lower over recent weeks. This means that relatively negative guidance will complement views already priced in to some extent, putting the risk of surprise-driven volatility on the upside.

WTI Crude Oil (NY Close): $91.85 // -0.01 // -0.01%

Prices are testing resistance at the would-be neckline of an inverse Head and Shoulders bottom (92.44), with a break higher implying a measured upside target at 97.90. Support stands at 87.66, the 38.2% Fibonacci retracement. A drop below that targets the 50% level at 83.76.

Daily Chart - Created Using FXCM Marketscope 2.0

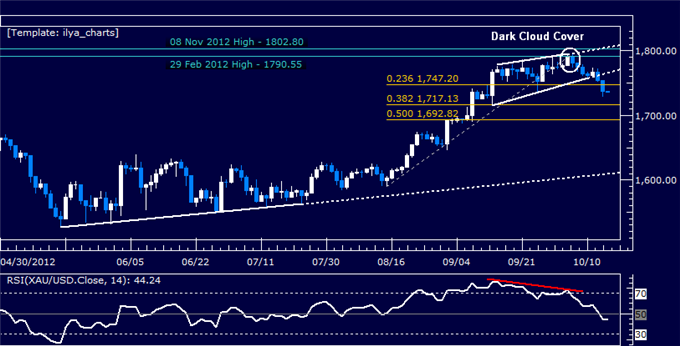

Spot Gold (NY Close): $1737.55 // -16.93 // -0.96%

Prices continue to break down as expected after putting in a Dark Cloud Cover candlestick pattern at resistance in the 1790.55-1802.80 area. Sellers have now broken past support at 1747.20, 23.6% Fibonacci retracement at, aiming to challenge 38.2% level at 1717.13 next. The 1747.20 level has been recast as resistance, with a reversal above that exposing the bottom of a broken Rising Wedge pattern now at 1766.28.

Daily Chart - Created Using FXCM Marketscope 2.0

Want to learn more about RSI? Watch this Video

Spot Silver (NY Close): $32.72 // -0.80 // -2.37%

Prices continue to decline as expected after forming a Bearish Engulfing candlestick pattern below the 35.00 figure. Sellers have now cleared range support at 33.66 and the 23.6% Fibonacci retracement at 33.18, exposing the 38.2% level at 31.83 next. The 33.18-66 area has been recast as resistance, with a push back above that targeting 35.00 anew.

Daily Chart - Created Using FXCM Marketscope 2.0

Want to learn more about RSI? Watch this Video

COMEX E-Mini Copper (NY Close): $3.702 // -0.002 // -0.05%

Prices edged through support at 3.707, the 23.6% Fibonacci retracement, to test the bottom of a falling channel set from mid-September (3.688). A push below this boundary targets the 38.2% level at 3.627. The 3.707 mark has been recast as near-term resistance, with a break above that aiming for the channel top at 3.800.

Daily Chart - Created Using FXCM Marketscope 2.0

--- Written by Ilya Spivak, Currency Strategist for Dailyfx.com

To contact Ilya, e-mail ispivak@dailyfx.com. Follow Ilya on Twitter at @IlyaSpivak

To be added to Ilya's e-mail distribution list, please CLICK HERE.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.