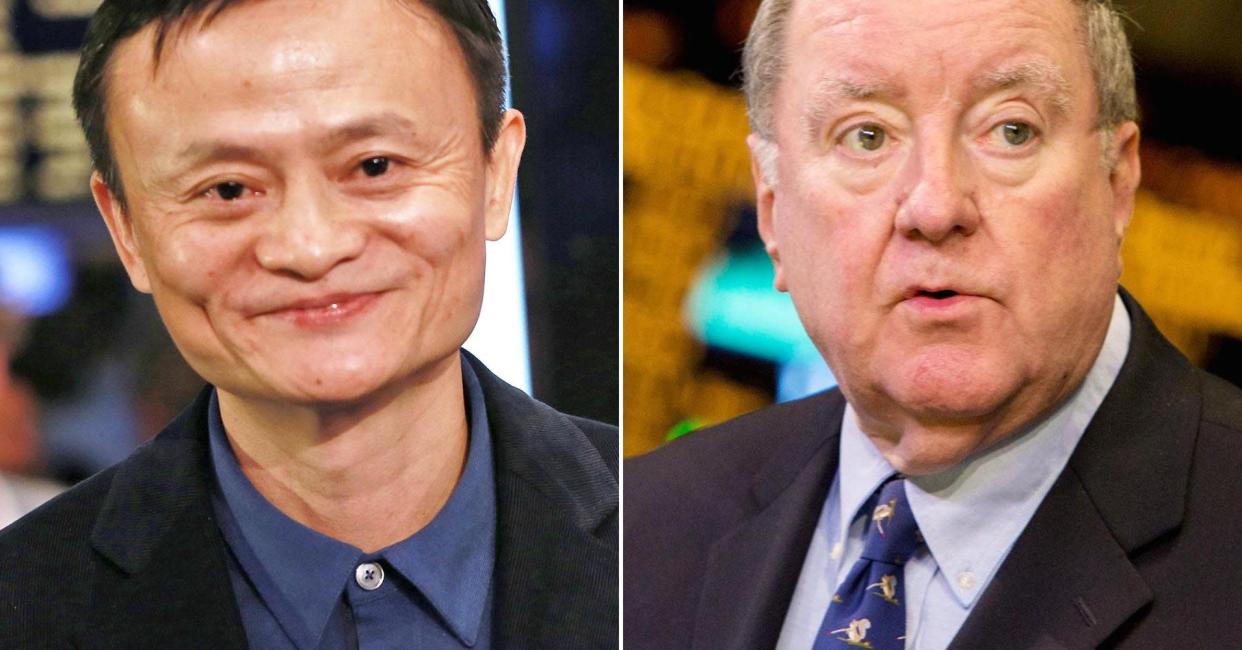

Jack Ma gets it-he LOVES Wall Street

On Friday, we saw the initial public offering in the U.S. of Alibaba (BABA) common stock. Thirty five of the world's largest investment banks participated in the largest U.S. IPO ever . There are 2.5 billion shares of Alibaba outstanding and the stock was up almost $26. This means Alibaba stockholders were up almost $65 billion from Friday's open to Friday's close. Not a bad day's work!

How is this IPO different? It was unlike Facebook (FB)'s IPO in 2012, which most of Wall Street agrees was a disaster. Facebook's stock was basically unchanged at the end of its first day of trading and held up by artificial support from the banks; three months after its IPO, it was down almost 50 percent. I doubt Alibaba follows in Facebook's path.

Alibaba's secret ingredient

This one had the exuberance of some infamous companies that went public in the late 1990s like Webvan, Pets.com and TheGlobe.com. However, Alibaba COULD be a success. It is nothing like those aforementioned companies. It is the world's largest retailer, has huge revenues, and has something else going for it.... Jack Ma.

I love Jack Ma. He came from nothing, took risks, worked really, REALLY hard and become a billionaire. In many ways, his story truly is the American Dream. The American Dream with one obvious difference...... he is 5-feet tall and idolizes Forrest Gump!

Read More Why Jack Ma likes Forrest Gump

When I watched his interview on CNBC, I noticed a few things: He values customers, employees and shareholders - in that order. He wants to revolutionize the world. He has a crush on Art Cashin. (Two out of three ain't bad!)

However, he isn't getting all starry-eyed by the glitz and glamour of an IPO - Wall Street's version of winning an Academy Award for Best Director. Unlike Mark Zuckerberg, he LOVES Wall Street. He is smart because he knows Alibaba needs Wall Street, just like Ariana Grande needs attention.

Where does Alibaba go from here?

It remains to be see whether the tremendous demand for Alibaba will be the sign of this current bull market's top tick. However if it wasn't for my slightly graying hair, annual prostate checkups and AARP Card, I'd swear it was 2000 again!

Is BABA overvalued... or undervalued?

They say size doesn't matter, but on Alibaba's first day of trading saw the company surge over 35 percent to a steamy $230 billion market capitalization!!

In sum, investors think Alibaba is worth more than Portugal's GDP!! Put it another way, if Comcast (CMCSA) merged with Kraf (KRFT)t and then Altria (MO) and American Express (AXP), Alibaba would still have bragging rights on size!! If Alibaba were to liquidate and turn that market cap into $100 bills it would form a ring that would circle the Earth 69 times. (OK, that last part might have been made up.)

Read More Confessions of a trader

But could it be undervalued!?? I don't know, because, like 99.9 percent of Americans, I have never been on Alibaba's site. Alibaba does have some huge advantages over its peers. China's Internet market is twice the size of the U.S. and the country seems to be skipping traditional retailing and going straight to e-retailing.

The scope of products on its Taobao site is astounding. It has thousands and thousands of non-name brand products. You can literally buy anything on Taobao. For your wife's surprise birthday party, you can buy her real Brazillian Virgin Hair, Argentinian Frozen Chicken Paws and a Gulfstream jet. (Maybe you can even get Jack Ma to sign the jet!)

Alibaba also has good relations with the government and that can't be discounted. In a country like China where the government can do whatever it wants, it seems that the government wants Alibaba to succeed. If the rules don't apply to Alibaba but they do to everyone else, then it should be easy to be a winner. Breaking the rules and not getting in trouble should be a benefit - unless your name is Roger Goodell.

At the end of the day, Alibaba is a tremendous success story for the founders and it seems to be a more legitimate business than some of the high flyers of previous cycles. That said, it seems that in the age-old battle on Wall Street between greed and fear, greed is in the lead. Right now greed just delivered a suplex to fear and is about to finish him off with a body splash off the top rope. In such times, it really seems like there is much more downside than upside to this stock - and the market as a whole.

Read More The 12 types of people on Wall Street

If I had to guess where Alibaba stock will be a year from now, I'd say not only will it be much lower, but the IPO will be a reminder to historians of the equity markets. It will remind historians that the No. 1 rule of history, is: People don't learn anything from history.

That being said, if you were lucky enough to get into Alibaba early and would be willing to have me on your yacht to St. Tropez, hit me on Twitter at @rajmahaltweets. I look forward to drinking your champagne, savoring your caviar and promise to bring my own generic Dramamine bought on Taobao.

Commentary by Raj Malhotra (Raj Mahal is his stage name), a former Wall Street trader-turned-stand-up-comedian. He has worked at Wall Street firms covering three continents, including at Bank of America (BAC), BNP Paribas and Nomura. He draws from his unique ethnic background and Wall Street career to entertain audiences nightly, highlighting the struggles of the 1 percent. He can be seen at Gotham Comedy Club, Broadway Comedy Club, NY Comedy Club, Greenwich Village Comedy Club, and the Tribeca Comedy Lounge. Follow him on Twitter @RajMahalTweets.

Read More Bitcoin tanks, is Alibaba to blame?