As Its Search Share Declines, An Analyst Says ‘Google Has Lost Some Of Its Mojo’

REUTERS/Joshua Lott

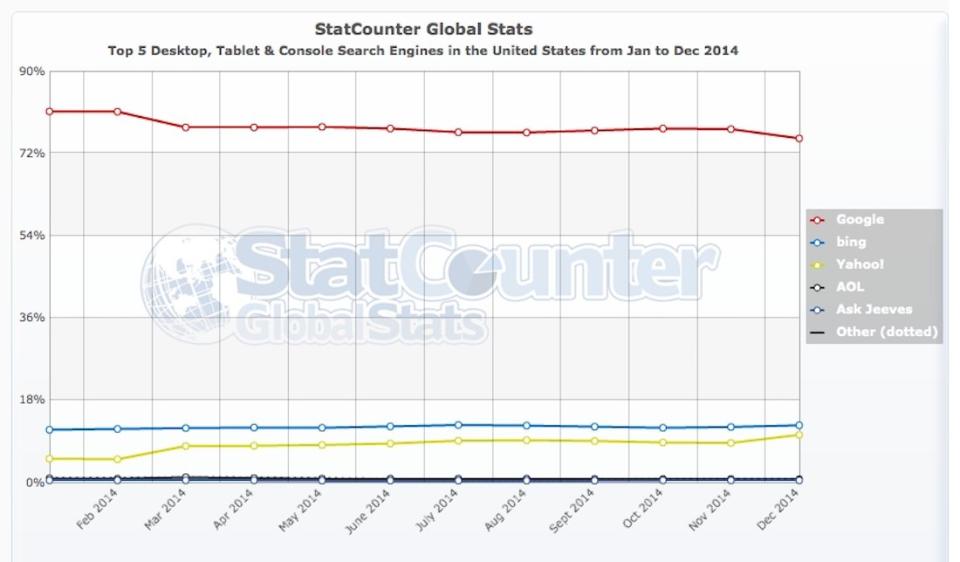

Google’s dominance of search is slipping. The technology giant recently saw the largest drop in its share of the search market since 2009, thanks to a Mozilla-Yahoo deal that saw Google replaced as the default search engine for the Firefox browser.

Google still leads the industry by a very comfortable margin — but there’s trouble on the horizon. Reports circulate that Apple is mulling over ditching Google as the default search for its iOS Safari browser, which would deliver a punch to both Google’s reputation and its bottom line.

Historically Google has been overwhelmingly a search company, generating revenues by peddling targeted ads alongside results on people’s desktops. But this is changing. A new research note by Baird Equity Research estimates that core desktop search now accounts for less than 50% of Google’s total revenues, as the company moves into the next phase of its life.

Here are R. W. Baird’s estimates on Google’s search revenues over the next two years:

R. W. Baird

This decrease isn’t necessarily a bad thing. As customers shift to mobile, it makes sense that Google would diversify its offerings so as not be left behind. But in this “Second Act,” Baird believes that Google no longer holds the unchallengeable position it once did. “Even among industry circles, there is a prevailing view that Google has lost some of its ‘mojo,’” they say, characterising the technology company as “down but not out.”

Google’s declining search market share.

In particular, the search giant is on a “competitive collision course” with other technology heavyweights. Internet behemoths have traditionally avoided major overlap in their core businesses — “Facebook in Social, Amazon in Retail, Priceline in Travel and Netflix in Internet TV” — but no longer.

Lines are starting to blur, and as Google’s reliance on desktop search decreases it’ll increasingly find itself encroaching on others’ turf. Google is also having its core products challenged. For example, Facebook is actively investing in its own video capabilities, attempting to make it a more attractive platform for content creators. Any success is likely to be at YouTube’s — and hence Google’s — expense.

As part of this diversification, Baird believes acquisitions could be on the horizon, suggesting Yelp, Netflix and Twitter as various potential targets.

With more than half of all mobile traffic coming from iOS, the loss of default status on Safari would be damaging for Google — but Baird doesn’t believe it’d be catastrophic. They estimate an impact on overall revenues of less than five percent. But it’d also have a symbolic impact: The loss of a key historic revenue source in a rapidly growing market, “adding another level to the… ‘wall of worry.’”

Baird’s verdict is that Google “remains well positioned to benefit from the bigger picture: ongoing growth off Internet services amidst a still-expanding global Internet audience.” The numerous platforms Google can leverage user data across offers it a unique “competitive advantage.”

But that the company so synonymous with search that its name became a verb is deriving less than half its revenue from the industry is a clear illustration of how much things have changed.

Read more stories on Business Insider, Malaysian edition of the world’s fastest-growing business and technology news website.