Malaysia: Consolidation Mode On In Jan 2013

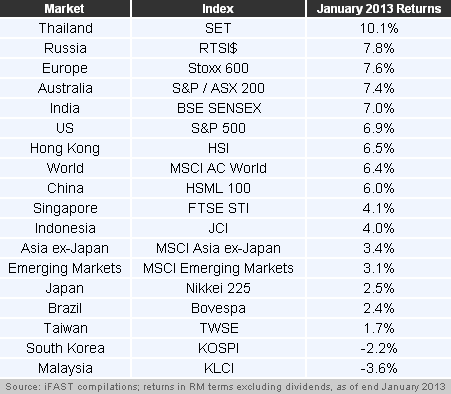

The FBM KLCI (benchmark index which represents the Malaysian equity market) closed at its new record high of 1,694.16 points on 7 January 2013, as the US avoided a “fiscal cliff” while improving economic data from China served as a catalyst to improve investor sentiment on the equity market. Despite these positive external factors, the FBM KLCI reacted negatively to the rumors of Parliament dissolution by end-February, plunging 40.8 points or 2.4% within a single trading day on 21 January 2013. As a result, the FBM KLCI ended the first month of 2013 as the worst-performing market under our coverage with losses of -3.6% (refer to Table 1).

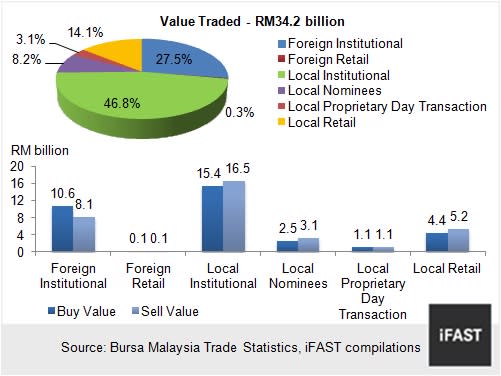

Based on trade statistics from Bursa Malaysia, the sell-down in January 2013 was dominated by local institutional investors, which made up 46.8% of the total traded value of RM34.2 billion (refer to Chart 1).

Of the FBM KLCI's 30 component stocks, losers outnumbered gainers by 22 to 8, with Axiata Group Bhd (Axiata), DiGi.com Bhd (Digi), Public Bank Bhd, CIMB Group Holdings Bhd and Malayan Banking Bhd the major laggards within the index. It is not surprising that the CIMB-Principal Equity Aggressive Fund 3, RHB Malaysia DIVA Fund, AmIttikal and index-linked funds such as AMB Index-Linked Trust Fund and KLCI Tracker Fund, which were heavily invested in these five index component stocks, were the worst-performing Malaysian equity funds and underperformed the broad-based index by delivering returns ranging between -3.8% and -4.3% in January 2013.

TECHNOLOGY – GLOBAL CHIP SALES IMPROVED

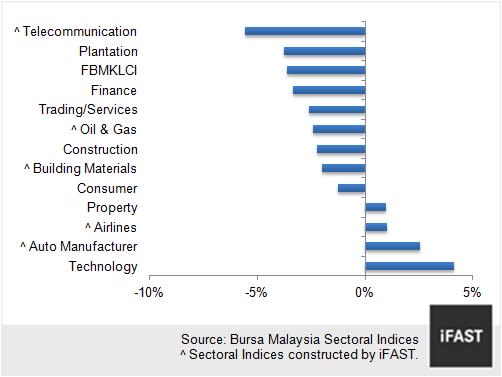

After having underperformed in 2012, the technology sector started the year by outperforming the other sectors with a 4.1% gain in January. We believe that the outperformance of the technology sector was partly due to rotational focus on laggards as the technology sector suffered a huge loss of 20.6% in 2012 as a result of weak global semiconductor demand.

Last year, we maintained a bearish view on the local technology sector as we believed the sector would be negatively impacted by the declining demand from major economies such as US, Europe and China. However, looking into 2013, the local technology sector is likely to fare better compared to last year.

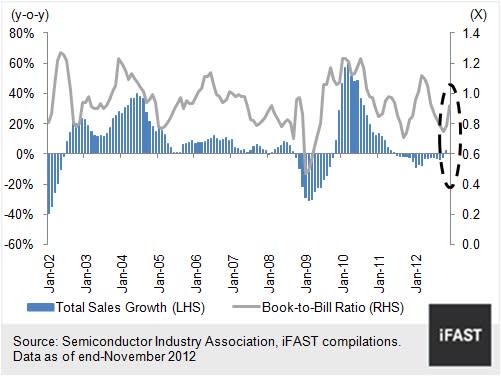

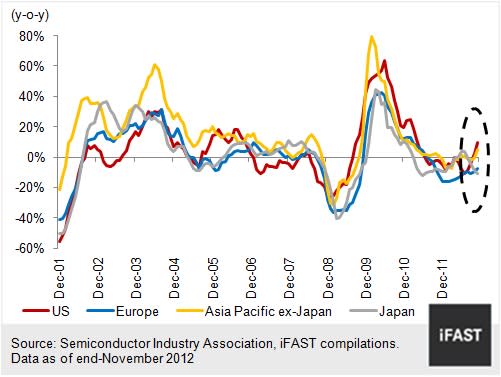

According to the Semiconductor Industry Association (SIA), global chip sales showed improvement with sales in November 2012 growing 2.0% year-on-year after contracting for 16 consecutive months (refer to Chart 3). The rebound in November 2012 was mainly due to the rebound of chip sales in US and Asia Pacific ex-Japan. Chip sales in Europe and Japan still remained weak, contracting by 7.6% and 10.7% year-on-year respectively in November 2012 (refer to Chart 4). With our expectation of the Eurozone to post modest growth in the latter half of 2013 and China economic growth accelerating once again this year, chip sales in Europe and Asia Pacific ex-Japan are likely to trend higher in 2013, which should result in the local semiconductor manufacturers seeing demand for their products gradually picking-up.

TELECOMMUNICATION – TUMBLED ON EPF’S DISPOSAL

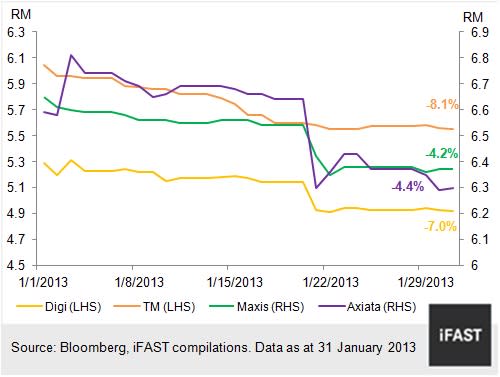

High dividend-yielding telecommunication stocks were the favourites of investors in 2012. This trend helped the telecommunication sector to deliver strong returns of 36.4% in 2012. However, Employees Provident Fund (EPF) made a large divestment of Axiata and Digi on 21 January 2013, which resulted in these two index component stocks plunging 5.1% and 4.1% respectively on that single trading day. Further disposal from EPF towards the end of January exacerbated the downward trend of telecommunication sector, with Maxis Bhd (Maxis), Telekom Malaysia Bhd (TM) and Digi closing lower, delivering -4.2%, -8.1% and -7.0% returns respectively in January 2013. Buying interest from Skim Amanah Saham and Khazanah Nasional Bhd after 21 January 2013 mitigated the decline of Axiata, which delivered a -4.4% return in the month (refer to Chart 5). On the whole, the telecommunication sector plunged -5.6% in January 2013.

Due to the impending general election, more defensive high-yielding telecommunication stocks may remain favoured by investors, which could see further yield compression for the sector going forward, especially for Maxis and Digi, as the current indicative dividend yield for these two stocks may be perceived as attractive for yield-hungry investors, ranging between 5.5% to 6.2% (data as at 5 February 2013). Nevertheless, notwithstanding the recent plunge, we believe that telecommunication sector is reasonably priced and valuations are not as attractive as before after the sector’s strong run-up in 2012.

OUR ADVICE

We maintain a favourable view on equities vis-à-vis fixed income, especially when valuations for most of the equity markets (especially North Asia) under our coverage remain attractive.

As at 4 February 2013, the estimated PE ratios for FBM KLCI are at 14.6X and 13.4X for 2013 and 2014 respectively, which are lower than its fair PE ratio of 16.0X. We estimate its upside potential to be around 19.6% by end-2014 if the market normalises to its fair level.

With the 13th General Election just around the corner, we do expect the Malaysian equity market to have a short-term consolidation to price in the election risk. However, we do not believe that the coming election will have a significant long-term negative impact to the fundamental issues such as economic and earnings growth. As such, we advocate investors to look past the coming election and stay invested, while market weakness on election fears may provide longer-term investors with opportunities to add to their holdings.

Having said that, amongst the various regional and single-country markets under our coverage, the Malaysian equity market is among those with the lowest upside potential and as such, we recommend investors who are currently invested in the Malaysian equity market to take on a more geographically-diversified approach, and to consider switching some of their holdings into more undervalued markets such as the Greater China region and South Korea.

Related Articles