Business 2 Community

Business 2 CommunityTop 5 Mistakes Investors Make

The difference between successful investors and unsuccessful ones is often as simple as doing a few things right and steering clear of some common mistakes. Avoid these 5 traps and you’ll be well on your way to achieving your financial goals.

Don’t Fly Blind

Would you start a major project at work without first setting some goals and creating a plan of attack to accomplish them? What about if you were remodelling your kitchen or buying a car? The answer is “of course you wouldn’t”. So why do so many people fail to create a plan for their long-term financial goals? In fact , in a recent Wealthminder survey, 82% of respondents said they did not have a formal financial plan. These people are flying blind. Don’t be one of them. Creating a basic financial plan isn’t complicated and doesn’t have to be very time consuming. Answering a few simple questions about your goals, your current financial situation and your willingness to take risk is enough to see whether what you are doing is likely to work or not. Once you have a plan in place, it becomes much easier to judge if you’ve gone off-course and it gives you a framework for making decisions on how to get back on track.

Focus on the Big Picture

When is the last time you thought about whether to buy or sell shares in Apple? How about when you last thought about what percentage of your portfolio should be in emerging market stocks? The reality is most investors spend all of their time thinking about questions like the first one and almost no time thinking about questions like the second one. The problem with this is studies show over 90% of your long-term returns are driven off of your asset allocation choices and not the individual assets you select.

A key output of any financial plan is a target asset allocation. Make sure your portfolio lines up with your planned allocation and you’ll be a step ahead of the crowd.

The Early Bird Gets the Worm

It’s cliche, but the earlier you start the easier it will be to reach your goal. The primary reason for this lies in the power of compounding. There’s simple rule every investor should learn to help with understanding this. It’s called the “Rule of 72”, and here’s how it works. If you have an expected rate of return for your portfolio, simply divide that number into 72 and the result is the number of years it will take for your money to double. For example, if your portfolio is expected to gain 7.2% per year, it will take 10 years to double your money.

You can also use the formula to determine what rate your portfolio needs to grow at in order to double your money in a set number of years. For example, say I want my money to double every 8 years. Using the “Rule of 72”, I know I will need to earn a 9% return.

Now, let’s use the “rule of 72” to illustrate why starting early matters. Say we have 2 investors, Sally and Joe. Both invest $10,000 in a portfolio that will return 7.2% per year and never save another dime. The only difference is that Sally does this at 25 and Joe does it at 35. If they both retire at 65, Sally’s portfolio will have grown to 16 times it’s initial value, $160,000, while Joe’s portfolio is only 8 times larger at $80,000. The numbers only get bigger when you assume regular savings over those 10 years.

Don’t Buy High and Sell Low

I know, it’s obvious. Unfortunately, it’s exactly what most investors do. Study after study shows that investors follow the herd and pile assets into whatever has worked well in the recent past. Then, when those assets fall, investors hang on almost all the way to the bottom before selling in a panic right before things turn for the better. To illustrate these points, we’ll use a couple of examples.

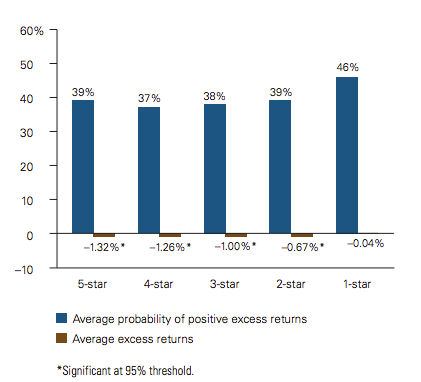

Morningstar is a widely respected company best known for it’s mutual fund rating system. Funds that get a coveted 5 star rating garner 90% of all new money going into mutual funds. Unfortunately for investors, the 5 star system is mostly about recent past performance, and as the chart below shows, you are actually more likely to pick a winning fund going forward from the 1 star pile than from the 5 star pile. Oops.

On the other end of the spectrum, let’s look at an example courtesy of Blackrock that shows how investors buy more as the market gets closer to a top and sell more closer to the bottom. While some will quibble that this is an oversimplification, the basic premise is sound.

Costs Do Matter

Last, but certainly not least are investment costs. Costs come in a variety of forms, but the biggies include fund expenses, trading costs, bid/ask costs and taxes. Studies have shown that the typical mutual fund with an average expense ratio and turnover rate has to outperform its benchmark by 2.5-3% per year just to match the benchmark after costs.

At first blush that might not seem like a lot, but if you assume that the average moderate portfolio is only expected to make 6-7% a year, that means the fund has to outperform the benchmark by 40-50% just to match its return after fees and taxes. Not surprisingly, the result is that most actively managed funds underperform their target benchmark and the magnitude of the underperformance is equal to the 2.5-3% penalty they are trying to overcome.

Wrapping It All Up

So, our 5 simple steps to getting ahead of the game are:

Start as soon as possible (like today!!)

Create a plan that helps you understand what you need to do to achieve your goals

Actually follow your plan (make sure your total portfolio’s asset allocation matches your plan’s)

Stick to your asset allocation and rebalance periodically to help you buy low and sell high instead of the other way around

Think about returns after fees and taxes when picking investments, because that’s what you get to keep

This article was syndicated from Business 2 Community: Top 5 Mistakes Investors Make

More Business articles from Business 2 Community: