An Optimistic Year Ahead For Asia Ex-Japan

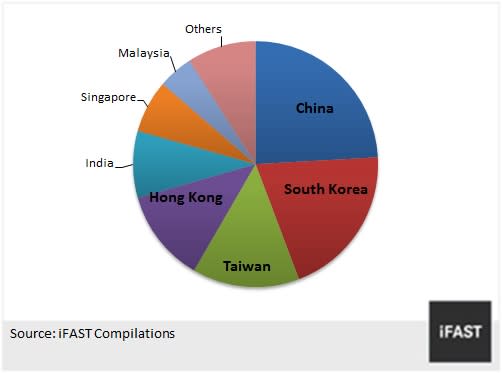

Led by Thailand, Singapore and Hong Kong, Asian equity markets outperformed in 2012, as the MSCI Asia ex-Japan index recorded 19.4% gains (in Ringgit terms). Referring to Chart 1, we can see that the Asia ex-Japan equity market is primarily constructed by four markets we have a favourable view on; China, South Korea, Taiwan and Hong Kong together make up over 70% of the MSCI Asia ex-Japan benchmark index. As we head into 2013, we continue to maintain a positive outlook on this region, with a 5-star or “Very Attractive” rating. In this article, we highlight some of the key reasons to consider investing in Asia ex-Japan now.

EXPORTS GROWTH TRENDS REVERSE: OPENED ECONOMIES TO BENEFIT IN 2013

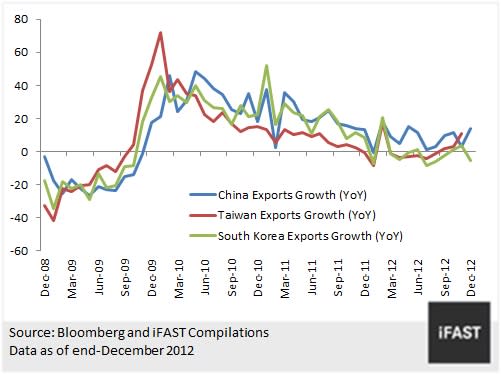

Faced with a global economic slowdown, 2012 was a difficult year for exports-oriented economies. This was one of the factors weighing on equity markets of North Asian countries, such as Taiwan, Korea and China, whose economies rely heavily on exports. However, looking at the latest economic data published by these 3 countries in Chart 2, we have started to see more and more positive signs in recent months suggesting that exports may have bottomed out in 4Q 2012.

Exports may have bottomed for China and Taiwan

Given the relatively insignificant weighting of Argentine bonds in the overall emerging market bond space, the current debt issues the nation faces will not materially change the fate of the overall sector. Extra liquidity caused by unconventional monetary policies adopted from US, Europe to Japan, will continue to find its way to emerging markets as investors’ risk appetite improves, and they will continue to search for higher yielding instruments. Plus, we expect the global economy to improve going into 2013, which will benefit the riskier segments of the fixed income space, including emerging market and high yield bonds. Thus, our outlook on the emerging market bonds remains favourable.

Outlook on Asian Exports for 2013

Heading into 2013, we expect that a recovery in global growth to benefit the exports-oriented economies most, boosting the outlook for North Asian countries such as China, Taiwan and South Korea, which are all heavily weighted in the Asia ex-Japan region. Latest figures from US also align with the overall recovery trend in the global economy, with some key economic indicators providing positive surprises.

However, it is still prudent to remember that downside risks to the global economy have not disappeared completely, especially as the recovery in exports to Europe has proved to be lagging behind the rest of the world. China and Taiwan’s exports to Europe had been contracting for much of 2012, but in December we finally saw the trend reverse with exports to the region gaining 2.3% and 11% respectively. However, South Korean exports to the European Union still remains weak, as it contracted 26.7% year-on-year last month. Despite the positive growth in exports to Europe for China and Taiwan, it is still too early to tell whether the trend has reversed. That said, we do expect economic growth in Europe to recover in 2H 2013, which will provide further support to Asian exports later in the year. Thus, we can expect economic growth in Asia ex-Japan economies to regain momentum this year, albeit at a moderate pace.

INFLATIONARY THREATS CONTAINED

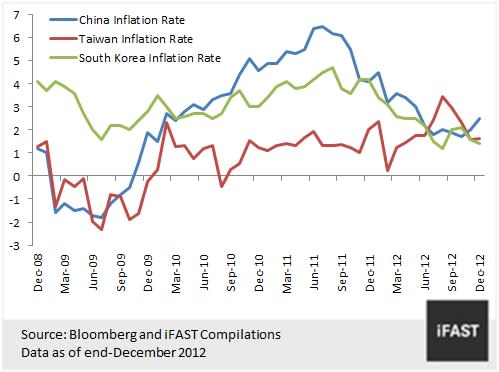

As we entered 2013, inflationary concerns remained relevant for Asian economies; high inflation levels left some central banks with a dilemma of whether it was too soon to loosen monetary policy to support growth. But the headline inflation figures for both China and South Korea moderated successively and have remained at controllable levels in the most recent months. The trend for Taiwan’s inflation rate is slightly different; food price inflation has been a particular issue for Taiwan in mid-2012, as poor weather conditions pushed inflation up to the highest level in four years. Nonetheless, as the typhoon season is behind us, we should see inflation figures in the coming months to remain at controlled levels.

Implications of Controlled Inflation

The implication of controlled inflation is more room and flexibility for the respective central banks to adjust monetary policy and focus on stimulating growth. That said, despite tame inflation rates, aggressive rate cuts may not necessarily follow. In particular, the People’s Bank of China has actually paused rate cuts since July 2012 due to the threat of resurging inflation and housing price risks. The latest 2.5% inflation rate in December also took markets by surprise, leaving the possibility of further loosening monetary policy lower. While we believe a 2.5% inflation rate is still tame and controlled, the central bank will closely monitor economic conditions to decide its policy moves. If growth momentum maintains, the central bank may not see it as necessary to loosen policy, as housing price risks starts to become a larger concern. (See Why Hasn’t There Been More Policy Easing in China? for more on this topic)

Finally, we do note that tame inflation is not prevalent in all Asian economies. The inflation rate in India has remained stubbornly high since 2010. However, the bright spot is that the wholesale price index for December lowered to 7.18%, the lowest level in 3 years. Although the rate remains relatively high, the market consensus appears to deem this sufficiently low to prompt the Reserve Bank of India to lower interest rates in January.

WEAK US DOLLAR TO SUPPORT ASIAN CURRENCIES

The Fed Announces QE3 and QE4

As we mentioned in our previous article, the implementation of unconventional monetary policies by major central banks across the globe will create excess liquidity in the markets. This in turn will find its way to Asia ex-Japan equity markets as well as global emerging markets. In addition to the third round of quantitative easing (QE3) announced by the US Federal Reserve in September 2012, the Fed proceeded to implement a fourth round of QE in December 2012. The latest programme will see the central bank purchase US$45 bn worth of long-term Treasuries each month. The two programmes combined will bring the total amount of securities that will be purchased by the Fed each month to US$85 billion.

Potential Currency Appreciation as Additional Source of Return

As the Fed flushes the markets with supply in US dollars, this will inevitably depress the currency value. Other central banks such as the Bank of Japan and European Central Bank have also embarked on such unconventional monetary policies, so it will be the Asian currencies, excluded from the “currency war” (caused by aforementioned policies), to see their values appreciate.

40% UPSIDE POTENTIAL!

While Global Emerging Markets (GEMs) is our most favoured equity region this year, the region does include a significant 58% portion of Asia ex-Japan markets. Naturally, our positive outlook on GEMs to some extent reflects our positive outlook on the Asia ex-Japan equity markets. Although the MSCI Asia ex-Japan index has already recorded impressive returns of 19.2% in 2012, the region still boasts one of the highest upside potentials of 40% up until 2014 (as of 11 January 2013). Plus, the market’s valuations remain attractive, with its 2013 and 2014 estimated PE at just 11.6X and 10.3X respectively (as of 11 January 2013), lower than its fair PE of 14.5X. Therefore, we maintain our favourable 5-star rating or “Very attractive” outlook on the market, and recommend investors to capture this investment opportunity while it’s not too late!

Related Articles