Business 2 Community

Business 2 CommunityWhy Have Bonds In A Portfolio?

Today we are going to briefly discuss the role bonds play in an investor’s portfolio. This is the third article in our three part series on bonds.

The Role of Bonds

Bonds are meant to provide portfolios with a stable base, and there are several ways they do this. First, bonds are far less volatile than stocks. In plain English this means they don’t go up or down in price nearly as fast as stocks do. A really good or bad year for stocks could mean gaining or losing close to 50 percent of your money. With bonds, a really bad year might mean you lose 9 percent.

Second, bonds and stocks tend to have a low level of correlation. This means that when stocks go down, bonds often go up and vice versa. By owning some of each, you reduce the size of the ups and downs in your portfolio, which helps you sleep better at night and reduces the likelihood you panic and make a poor emotionally based investment decision.

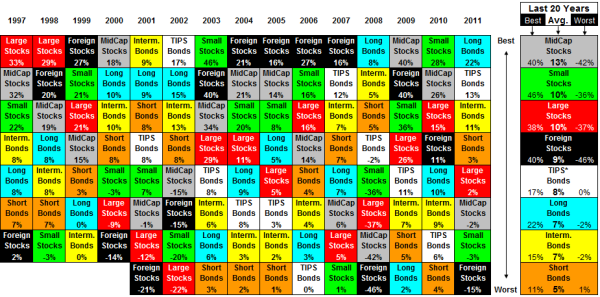

To see these two points in action, take a look at the chart below. While it’s a bit of a mouthful, the year by year returns on the left show you how bonds tend to do well when stocks don’t (look at 2001, 2002 and 2008), and when stocks are rocking, bonds take a back seat (look at 2003 and 2004) . The data on the right shows you how stocks have averaged more than bonds over the long term, but with much higher highs and much lower lows on a yearly basis.

A third way bonds help stabilize a portfolio is through income generation. Most of the returns you get over time in bonds come from the interest they pay. This is a fixed and known amount promised to you by the borrower. Short of a default, it’s something you can count on.

Baseball And Bonds

Although I’m not a huge baseball fan, here’s a simple analogy that hopefully helps illustrate the key concepts we just discussed. A good baseball team requires a mix of different types of talent. Take hitting for example. There are 2 primary types of hitters: power hitters and guys who hit for average. Power hitters are kind of like stocks. They hit a lot of home runs but they also strike out a lot. Bonds are more like guys who hit for average. They hit a lot of singles and get on base a lot, but they don’t tend to hit many home runs or strike out a lot.

If your baseball team was made up entirely of either power hitters or hitters for average, you wouldn’t score a lot of runs on a consistent basis. You’d have a lot more games where you either scored a ton of runs or no runs at all. Having a mixture of the 2 types of hitters increases your chances of consistently scoring runs, which increases your chances of winning more games. Having a mixture of stocks and bonds can do the same thing for your portfolio.

Now what?

Hopefully you’ve found our series on bonds helpful. In the first article we learned how bonds are priced , some key terms (like par, coupon and maturity), important bond dates, and different ways to think about yield. We followed that with a discussion of the different types of bonds you can buy and some of their important differences. Finally, we discussed some key reasons you should include bonds in your portfolio.

This article was syndicated from Business 2 Community: Why Have Bonds In A Portfolio?

More Business articles from Business 2 Community: